“The nine most terrifying words in the English language are: ‘I’m from the government, and I’m here to help.’”

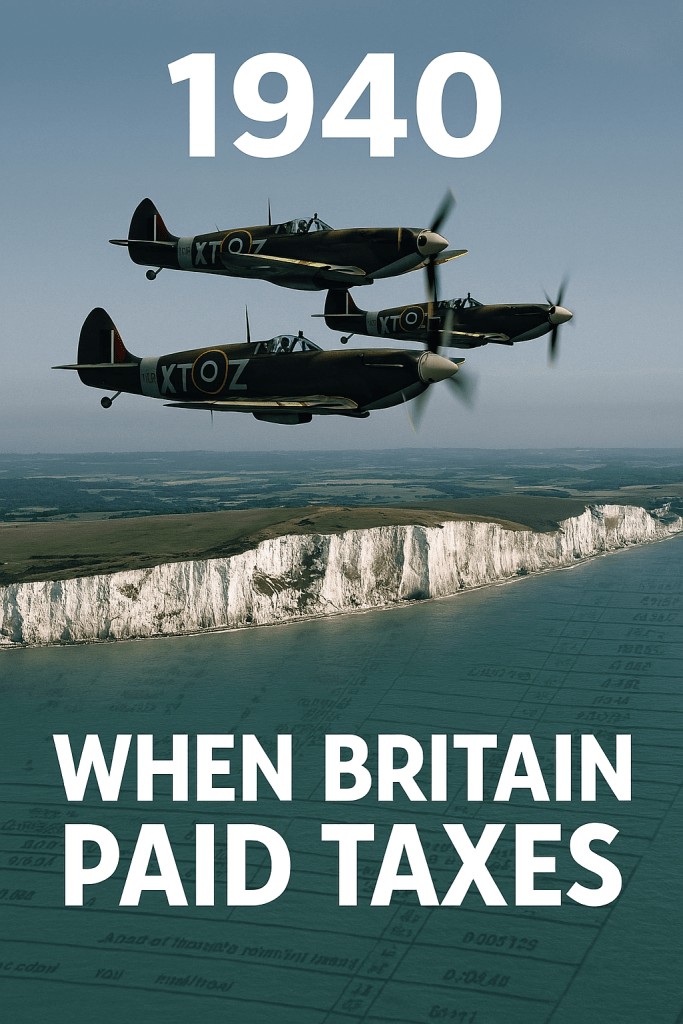

These words of Ronald Reagan were the best and most concise summary ever of the creed of Neoliberalism, which he shared so avidly with Margaret Thatcher. They called themselves Conservatives: but their belief was utterly radical, dominating all public discourse and transforming the world at least until the Great Crash of 2007-2008.

The radical nature of that transformation is laid out by Branko Milanović in The Great Global Transformation. We have two reviews for you, one via the inestimable Nature Briefing [1] and the other by Ivan Radanović for the equally prestigious London Review of Books [2] As ever we won’t spoil these excellent pieces, humbly begging you to read both. However we could not resist this passage from Radanović’s review. For it highlights the contradiction at the heart of the Reagan led project which would ultimately bring it crashing down:

For Branko Milanović and many others, China is at the centre of the current ideological paradigm shift. China’s rise, enabled by global neoliberalism, also made the end of global neoliberalism inevitable, by growing too big to be integrated into a global order whose rules are written by the US and its allies.

The Chinese saw a blindspot which the complacent westerners had missed: if you build an economy where the private sector is good and the state bad, how do you cope when foreign governments act like private companies? In Britain many utilities privatised by Thatcher are owned by foreign governments: is that Socialism or Capitalism? The shrewd rulers of China simply flipped this conundrum: the State and the Communist Party oversee the activities of a thriving private sector. Is that Socialism or Capitalism? In which case, what do words like “Conservative”, “Liberal” and Neo Liberal” really mean?

Milanović worthily joins a list of critics of the Neoliberal project including Wilkinson and Pickett, Thomas Piketty, and Will Hutton. It is easy to see Neoliberalism’s faults now, but it was very popular once. And before we rejoice its final passing, what follows may be very much darker indeed.

[1]“Nationalism grows on the terrain of never-satiated mass plenty and greed,” writes economist Branko Milanovic in his new book, The Great Global Transformation. Milanovic argues that globalization benefited previously poor populations, notably those in China, and the already rich, but left the middle and lower classes in countries such as the United States behind. The result is “the exponential growth of ‘nationalism, greed and property’”, writes sociologist Roberto Patricio Korzeniewicz in his review. “For Milanovic, greed is the iron cage of our times, and our future is bleak.”

#politics #economics #Ronald Reagan #free markets #capitalism #socialism #communism