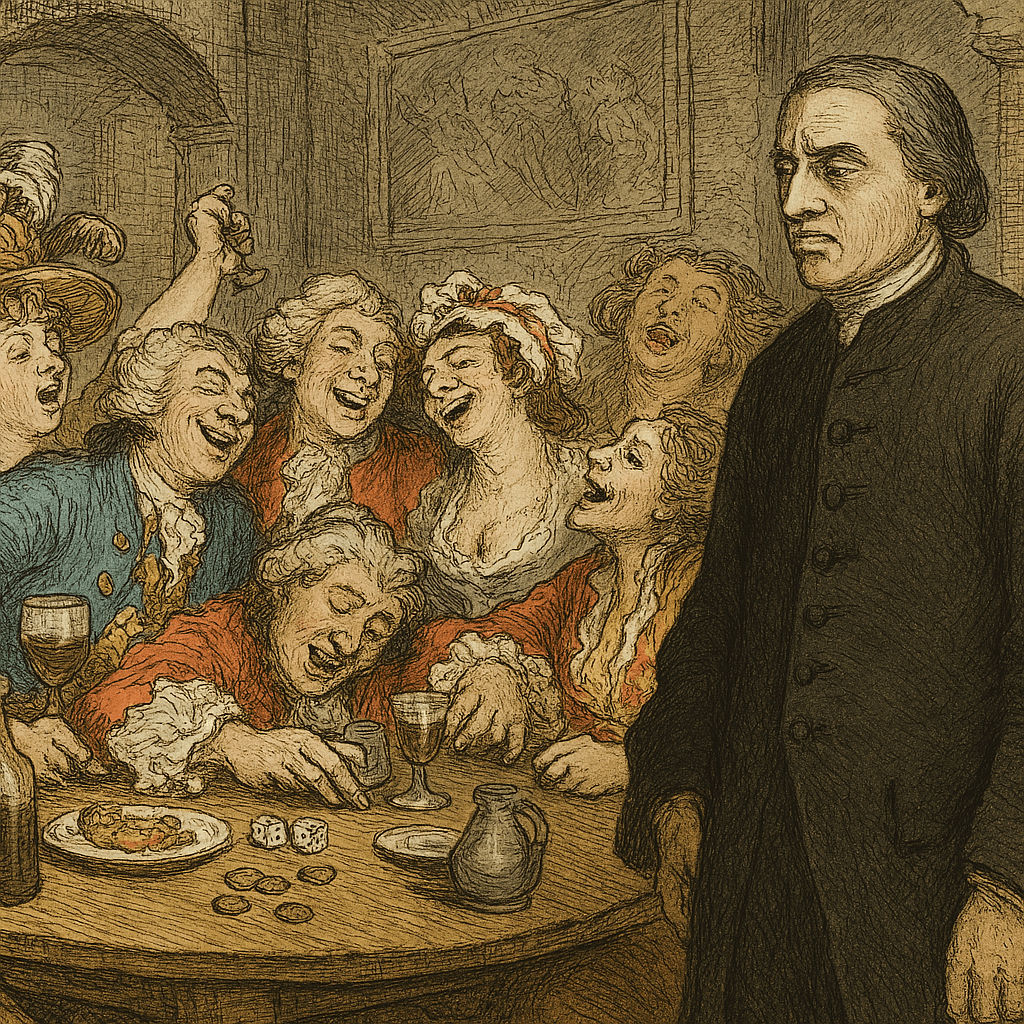

As we write. the current troubles of UK Prime Minister Sir Keir Starmer are profound. One of the reasons they are so bad is that, almost before he took office, almost no one has warmed to him: many evince active dislike. Meaning this serious, intelligent man can draw on no reserves of public goodwill in the way that a more raffish character like say Boris Johnson could. Why?

We think part of the answer lies in this article by Larry Elliott. For it charts Britain’s fall from manufacturing powerhouse to fragile services-led house of cards in a few punchy paragraphs, while noting China’s almost inverse trajectory to high tech manufacturing superpower. How so? Elliott compares the policies of two politicians who took power at around the same time in their respective nations: Deng Xiaoping and Margaret Thatcher. While the former did everything he could to foster manufacturing, the latter, a true disciple of unfettered free markets, believed:

…… market forces should determine which businesses thrived. If Britain excelled in financial and business services……… That’s what the country should concentrate its efforts on, while other nations made the ships and the machine tools

Underwritten by the short term unearned bonanza of North Sea Oil, this catechism was applied unchecked. With the results we see today. No British Government will ever again have the resources to satisfy the clamours of its citizens-for hospitals, for thriving high streets and clean water, nor create the booming economy they crave. But, used to abundant wealth and easy answers, these citizens still think like spoiled heirs burning through the last remains of the family patrimony. So any sensible family lawyer like Starmer, who tries to utter the self-earned nature of their plight, will pass unheeded, or worse, actively scorned. Such people will always prefer a story teller to a truth teller. And for a way forward? Restore manufacturing, to which end Elliott has some policy recommendations of course . But his real answer is psychological, not economic.

The bottom line is that to rebuild manufacturing Britain has to see the world through the prism of a developing country not a developed one.

In other words -forget its pride.

#economics #UK #China #Deng Xiaoping #Margaret Thatcher #manufacturing #politics